Q

Opening a bank account in Turkey is considered one of the most important matters for citizens and residents due to the daily conveniences it offers us. Among the prominent conveniences it provides is the complete management of legal affairs related to residence, work, purchases, transfers, and more, all through mobile banking from the comfort of our homes.

What are the documents required to open a bank account in Türkiye?

The papers required to open a bank account in Turkey change according to which bank you choose and according to the nationality. We will mention all the necessary papers, specifying the most important papers or documents.

1- residence permit (residency card)

The residence permit is the basic matter that any bank requires from you in Turkey, and the types of residence permit differ, including tourist residence, work residence, real estate residence, temporary protection card (Kimlik) for Syrian nationality. Without this residence permit it is not possible to open a Bank of Türkiye account.

2- Passport

A valid passport, meaning that its validity period has not expired, is one of the main important papers for all nationalities, except for the Syrian nationality in specific cases, which we will mention later.

3- A work permit

A paper is requested to prove to the bank the status of the person in relation to work, and it is a paper that the person takes from the employer to prove that the person is working, and this paper is not required by all banks, but in the majority of foreigners who are in Turkey

4- Residence accommodation

This paper is extracted from any civil department or municipality affiliated to the same place of residence exclusively, and the name of this paper in the Turkish language is ikametgah and the Arabic language is pronounced (Ikametgah), or this paper can be extracted through the government application e-Devlet, which we will explain in full in the article The most important applications in

5- Tax number

Tax number Only a small percentage of Turkish banks request this paper, and it is extracted from the tax department

What are the difficulties that can be encountered while opening a bank account in Türkiye?

There are many difficulties that may be encountered when opening a bank account in Turkey, and these difficulties can be easily overcome by following these steps.

1- Too many papers required from the bank

Always try to open a bank account with banks that deal largely with Arabs and government and not private banks such as Ziraat Bank, Ziraat Islamic Bank Ziraat Katılım, Albaraka Türk Katılım Bankası, or Işbank

2- The difficulty of the employee not knowing the necessary papers for foreigners

Here, unfortunately, this is the biggest problem that you can face while opening a bank account in Turkey, which is the employee’s lack of proper knowledge of the laws, and to solve this problem, you have to book a role with another employee or change the branch to another branch of the same bank, and it is preferable to go to the main branch always

Since most of the time the employee tells you directly that we do not open accounts for foreigners, and this is not true. Only the employee or the branch does not have sufficient knowledge of the bank’s laws. When changing the branch, the problem is solved.

3- Language difficulty when opening a bank account in Türkiye

The problem of the language that we face in anything when moving to Turkey, and here it is preferable to have a translator with you or to know the basic words required of you during opening a bank account, or to search for another employee who is fluent in English.

4- The difficulty of depositing huge sums when opening a bank account in Türkiye

Some Turkish banks in the year 2020 ask the customer to deposit huge amounts of money from 5 thousand dollars to 20 thousand dollars for a month in the bank, which is unreasonable for the majority, and to solve this problem also change the branch and it is preferable to go to the main branch of the same bank where these demands are bypassed.

What are the facilities offered by opening a bank account in Türkiye for a foreigner?

We mention the most important facilities in order starting from the most important, and also during the Corona crisis, additional features are opened daily to reduce gatherings and deal with paper money.

- 1- Receiving the work salary through the bank, which is compulsory in the event that you have a work permit card.

- 2- Pay the house rent through the bank to guarantee your right, as we mentioned in the article on housing and rent in Turkey.

- 3- Paying home bills through the bank without the need to go to bill payment centers.

- 4- Online purchase internally or externally

- 5- Registration in sports clubs exclusively through the bank.

- 6- Transferring money to friends or family.

- 7- Pay insurance or taxes through the bank.

- 8- Subscribing to any online services.

- 9- Keeping money within the bank and withdrawing when needed, especially in the case of shared housing for safety.

- 10- Complete shopping for food, drink, clothing, etc.

Is a foreigner entitled to open a bank account in Türkiye? Credit Card ?

Yes, a foreigner has the right to open a credit card account, but within specific conditions, which is adding a security amount in the bank, starting from 1000 Turkish liras paid in advance, and the amount is reserved throughout the period of possession of a credit card account, and the amount is returned to you later when the account is closed.

And the insurance amount is 1,000 pounds or more, which is the maximum usage limit, which you must return every 21 days to the bank, or you will have small interest in the event of non-return.

What is the most popular bank to deal with Arabs and the easiest to open a bank account in Turkey?

Ziraat Bank is the most bank that deals with Arabs in Turkey due to the facilities it provides to customers and because it is a government bank, not a private one. It is one of the good banks due to the large number of services it provides.

How do I know banks with high services before opening a bank account in Türkiye?

All banks in Turkey are good and have high services, but the most important thing we look at before opening a bank account in Turkey is the number or spread of ATMs in the streets, and we mention most of the ATMs in the streets, the ATMs of Ziraat Bank, and the ATMs of İşbank , unlike Al Baraka Bank, which has ATMs in specific areas only.

Also, one of the important things for high services is the presence of a mobile application with additional features. Business Bank “İşbank” and Kuveyt Türk Bank are among the best mobile applications due to the presence of the English language and the large number of features.

Can I receive a Western Union transfer on my Turkish bank account?

The feature of receiving transfers through the bank transferred via Western Union was added in 2020, but only Turks or foreigners who have Turkish citizenship can benefit from this service.

And all nationalities residing in Turkey must go to the nearest bank or exchange shops affiliated with Western Union to receive their transfers by means of a residence card or an unexpired passport.

Do I need to go to the bank every time to activate any features or services within my account?

In most Turkish banks, you do not need to go to the branches to activate any features or services on your account, except for some services only. We will mention some of the services that you can activate only through the mobile application or the computer.

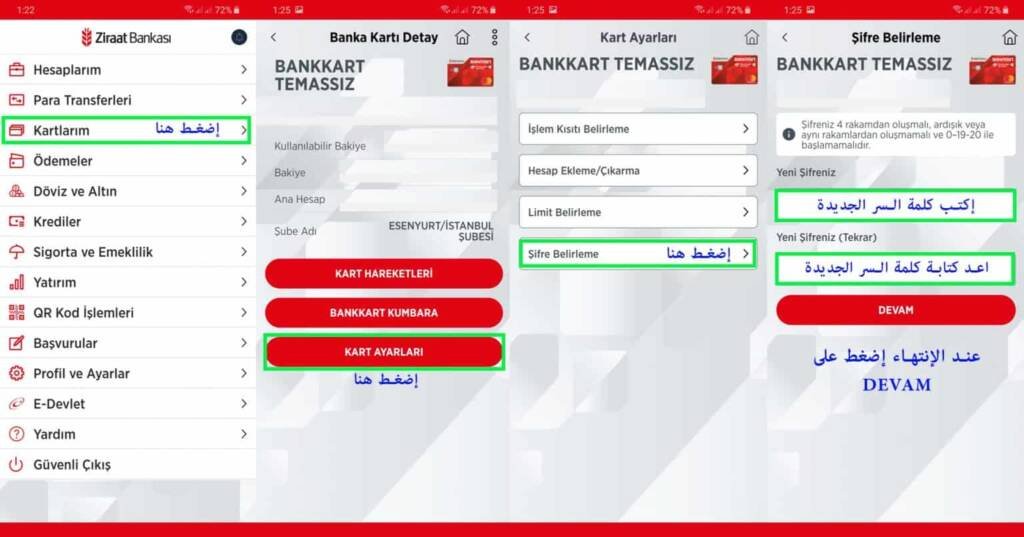

1- How is the password set for the new bank card?

You can create a new password for the newly received bank card, or change the previous password only via mobile, by following these simple steps.

2- How to unlock the online purchase feature via the mobile application?

When you receive a new bank card for the first time or if it is renewed, you will need to activate the online purchase feature and some other features. You can activate this feature through easy steps through the mobile application without the need to go to the bank.

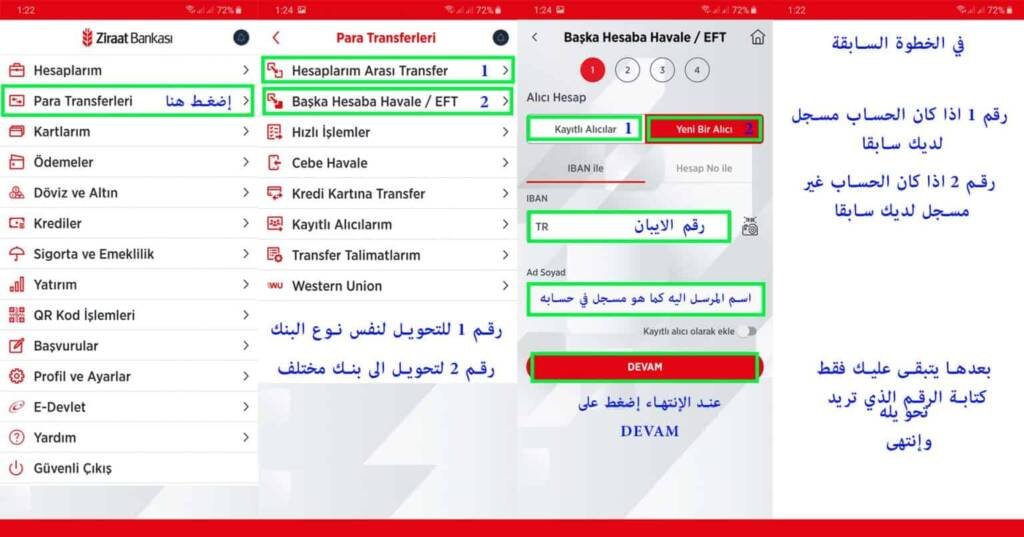

3- How can I transfer an amount to another person?

You can transfer money to a friend or family, or to the homeowner in case of rent, through easy steps through the mobile application.

4- How can I open a foreign currency account?

You can open a foreign currency account, such as a dollar account, a euro account, or any other currency account without the need to go to the bank, only through the mobile application, with simple steps, follow through the pictures.

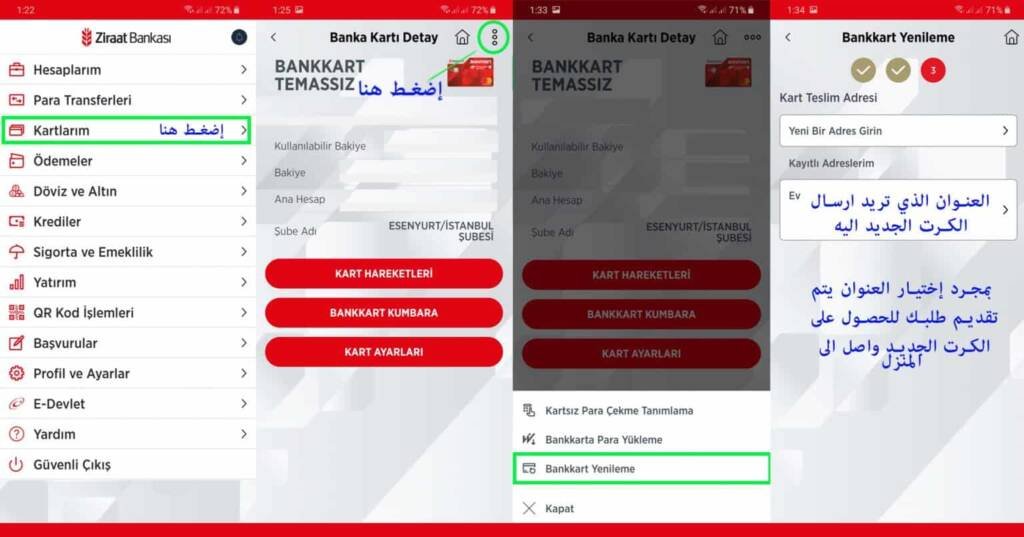

5- How to request a new home bank card?

In the event that the bank card is lost, stolen, or damaged, you can simply request a new bank card and stop the old one through simple steps through the mobile application without the need to go to the bank. Also, when the new card arrives, you need to create a password for the new card through the steps that we mentioned earlier.

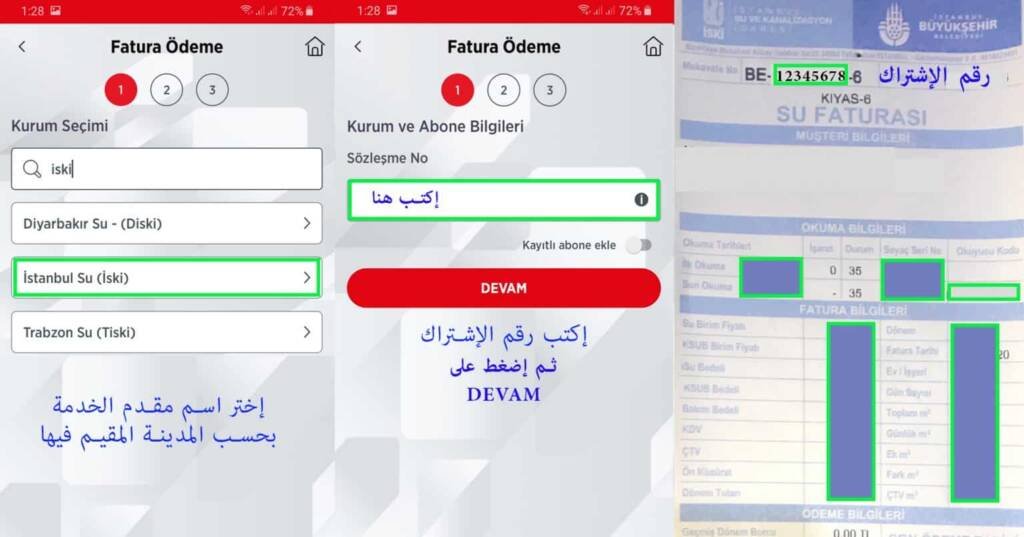

6- How to pay the entire house bills through the bank ?

As we mentioned earlier, you can pay all bills such as electricity, natural gas, internet, and water in simple steps without the need to go to bill payment centers and wait for the turn. In this example, we explained paying the water bill, and you can follow the same steps for any other bill.

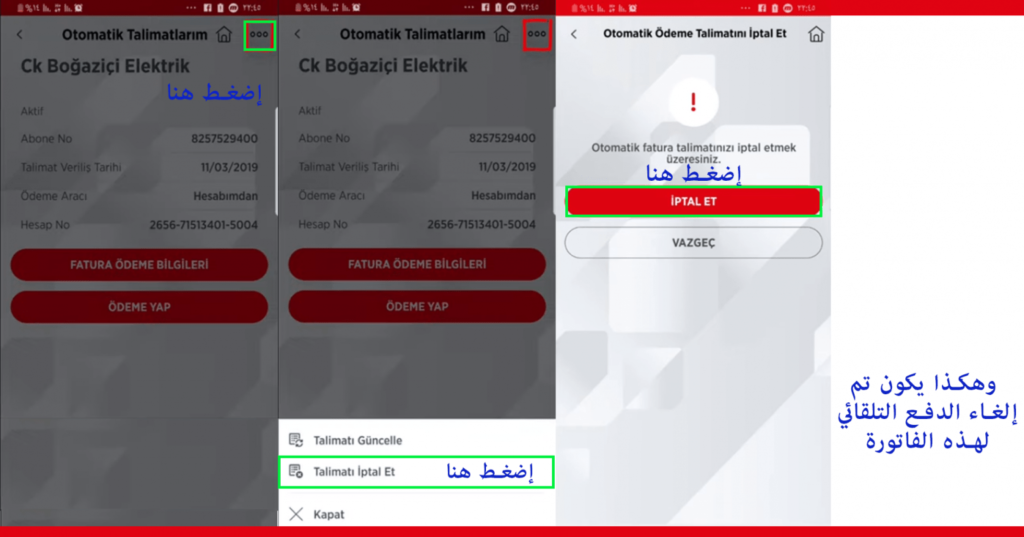

7- How can I cancel automatic bill payment?

When paying bills more than once, the Ziraat Bank account enables automatic payment of bills because it is a work that you do periodically, only this feature is for paying bills. To cancel this feature, just follow these simple steps via the mobile app.

Important notes and information:

1- Transfer fees:

As for the transfer fees, they differ from one bank to another, but always when transferring from one bank to another person’s account in the same bank, it is free, meaning there are no fees. As for from an account to an account in a different bank, there are transfer fees starting from 2 Turkish liras to 7.5 Turkish liras.

2- Process processing time:

In the event of transferring any sums of money to an account in a different bank or paying bills, it must be taken into account that the amount paid or transferred will not be deducted from your account except within the official working hours of the bank, and in the event of a late transfer, the amount will be deducted the next morning within the official working hours. And the amount transferred to the other person after deducting it from your account.

In the event of any additional questions or inquiries, you can leave a comment on the article or contact us on our accounts on social networking sites, and do not forget to visit the YouTube channel in order to know all the important topics.